Scoring Assessment System

The scoring system from CRIF Jordan is an indicator based on a statistical methodology used to predict the likelihood that a customer will delay in making at least one payment/commitment in the 12 months following the customer inquiry. A new definition of default has been adopted, classifying the inquired customer (at the time of inquiry) by considering all contracts provided about the customer as having exceeded 90 days from the due date (> 3 consecutive payments) within the last three months from the date of inquiry in at least one contract, with outstanding receivables equal to 50 Jordanian Dinars or more.

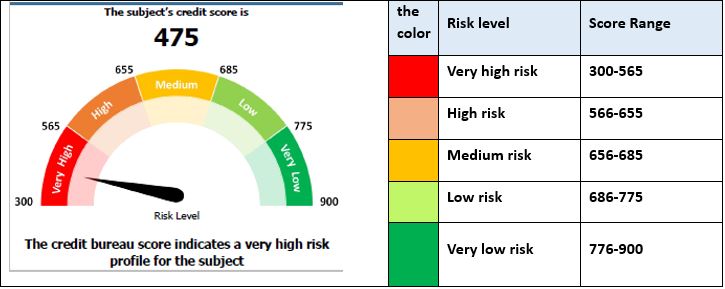

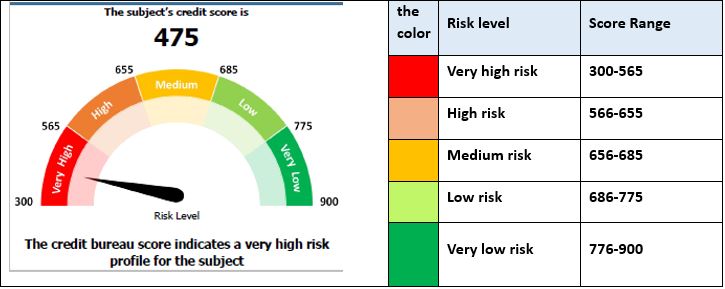

The score result is presented numerically, dividing customers into five risk levels as shown in the following table.

1. Reading the Result of the Scoring Assessment

Risk Levels for Indivisuals:

Risk Levels for Companies:

2. Calculating the scoring assessment result relies on key-elements and sub- elements, as well as the statistical factor of analyzing the client's data included in the database of the Credit Information Company. The main elements include:

The Main Elements Used in the Scoring Assessment System

3. Can the scoring assessment result be improved?

The scoring assessment result can be improved by doing the following:

Maintaining a good credit history

Maintaining a good credit history

Commitment to pay the payments / obligations prior to or on the due dates

Commitment to pay the payments / obligations prior to or on the due dates

Reducing the number of financial institutions that the client deals with

Reducing the number of financial institutions that the client deals with

Payment of facilities granted under credit limits

Payment of facilities granted under credit limits

Reducing the value of monthly obligations

Reducing the value of monthly obligations